Table of Contents:

- Introduction

- Impact on ITC and Tobacco Sector

- Market Response and Investor Sentiment

- Analyzing ITC’s Performance and Future Outlook

- Budget’s Fiscal Impact on FMCG Sector

- Conclusion

Introduction

The Union Budget 2024 presented by Finance Minister Nirmala Sitharaman has sparked significant movements in the stock market, particularly within the Fast Moving Consumer Goods (FMCG) sector. Notably, ITC, a major player in both tobacco and non-tobacco segments, witnessed a remarkable surge of over 5% in its share price following the budget announcement. This surge was largely driven by the government’s decision to maintain stable taxation on tobacco products, reassuring investors and stakeholders alike. The broader Nifty FMCG index also saw a substantial rise of 2.7%, underscoring positive market sentiment towards FMCG stocks. This article delves into the implications of the budget on ITC and the FMCG sector, analyzing the factors contributing to these market movements.

Impact on ITC and Tobacco Sector

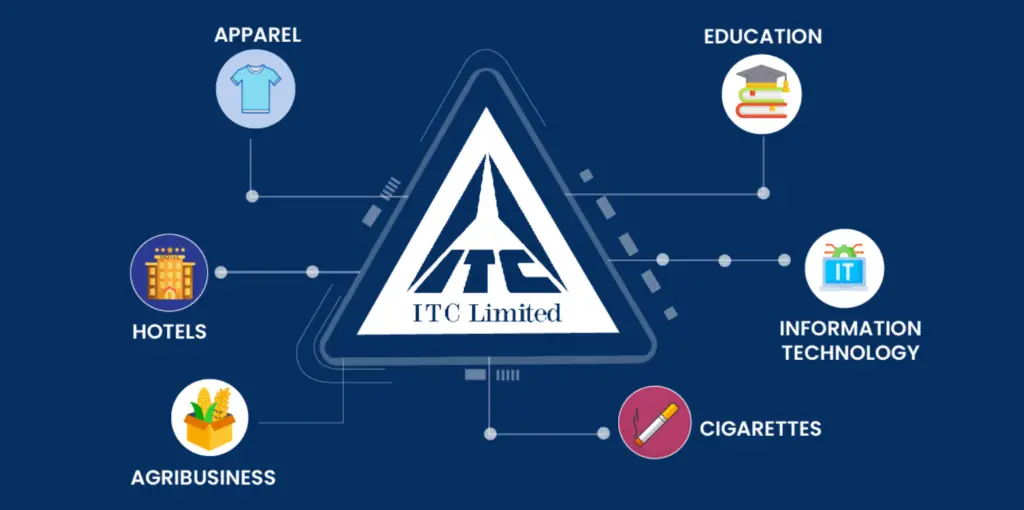

ITC, known for its diverse portfolio ranging from cigarettes to FMCG products, experienced a surge in its share price as a direct response to the budget’s tobacco taxation policies. With no changes in tax rates announced, the stability in taxation levels provided a sense of relief to stakeholders, particularly amidst previous hikes in National Calamity Contingent Duty (NCCD). This continuity in tax policy was pivotal for ITC, as it relies significantly on tobacco revenues despite efforts to diversify into other segments.

On the day of the budget, ITC’s stock opened at ₹467.05 on the Bombay Stock Exchange (BSE) and reached an intraday high of ₹489.80, reflecting investor confidence and positive market sentiment surrounding the company’s future prospects. Analysts and market observers have noted that the clarity provided by the budget regarding tobacco taxation has bolstered ITC’s position in the market, contributing to its strong performance within the benchmark indices, Nifty 50 and Sensex.

Market Response and Investor Sentiment

The immediate market response to the budget announcement was evident not only in ITC’s stock surge but also in the broader FMCG sector. The Nifty FMCG index, which tracks the performance of FMCG companies, recorded a substantial increase of 2.7% on the day of the budget. This rise underscores the favorable sentiment towards FMCG stocks following the budget’s supportive measures for the sector, including the allocation boost for rural development.

Investors and analysts have highlighted the positive implications of these measures, predicting a continued uptrend in FMCG stocks driven by increased consumer demand, especially in rural areas. The budget’s emphasis on rural sector allocations, coupled with expectations of economic revival, has positioned FMCG companies like ITC favorably in the market landscape.

Analyzing ITC’s Performance and Future Outlook

Looking ahead, analysts such as Ruchit Jain from 5paisa have pointed out that ITC’s recent stock movement indicates strong momentum supported by robust trading volumes. This trend suggests ongoing investor interest and confidence in the company’s ability to navigate through regulatory challenges and capitalize on growth opportunities in its non-tobacco segments.

Moreover, the expected revival in rural demand, backed by the budget’s rural-focused initiatives, is poised to benefit ITC’s non-tobacco businesses significantly. These segments, including FMCG and Agri, are integral to ITC’s diversification strategy aimed at reducing dependency on tobacco-related revenues.

Budget’s Fiscal Impact on FMCG Sector

The Union Budget 2024 also introduced several fiscal measures aimed at boosting the FMCG sector’s growth trajectory. One notable provision includes revisions in tax rates under the New Tax Regime, coupled with an increase in the standard deduction for individuals opting for this regime. These measures are expected to enhance disposable incomes, thereby stimulating consumer spending, which is crucial for FMCG companies like ITC, HUL, Dabur, and Nestle.

According to T Manish, a Research Analyst at SAMCO Securities, the budget’s fiscal incentives are likely to translate into tangible benefits for FMCG corporations. The increased standard deduction and revised tax slabs are projected to result in significant tax savings for individuals, which could potentially drive higher consumption across FMCG categories.

Conclusion

In conclusion, the Union Budget 2024 has had a profound impact on the stock market, particularly within the FMCG sector. ITC’s impressive stock performance, fueled by stable tobacco taxation policies, reflects investor confidence and optimism in the company’s strategic direction and diversified portfolio. The budget’s provisions aimed at bolstering rural development and consumer spending are expected to sustain the positive momentum in FMCG stocks in the coming quarters.

As investors and stakeholders continue to assess the budget’s implications, the focus remains on how companies like ITC navigate regulatory landscapes and leverage growth opportunities in a dynamic market environment. With supportive fiscal measures in place, the outlook for FMCG stocks appears promising, underscoring their resilience and potential for growth amidst evolving economic conditions.

Tags: Union Budget 2024, ITC stock price, Nifty FMCG, tobacco taxation, FMCG sector, market analysis

External Links:

Also Read: Gold Rate सोने की कीमतों में गिरावट: बजट 2024 के बाद खरीदने का अवसर?