Table of Contents

Overview of Wipro’s Q1 FY25 Performance

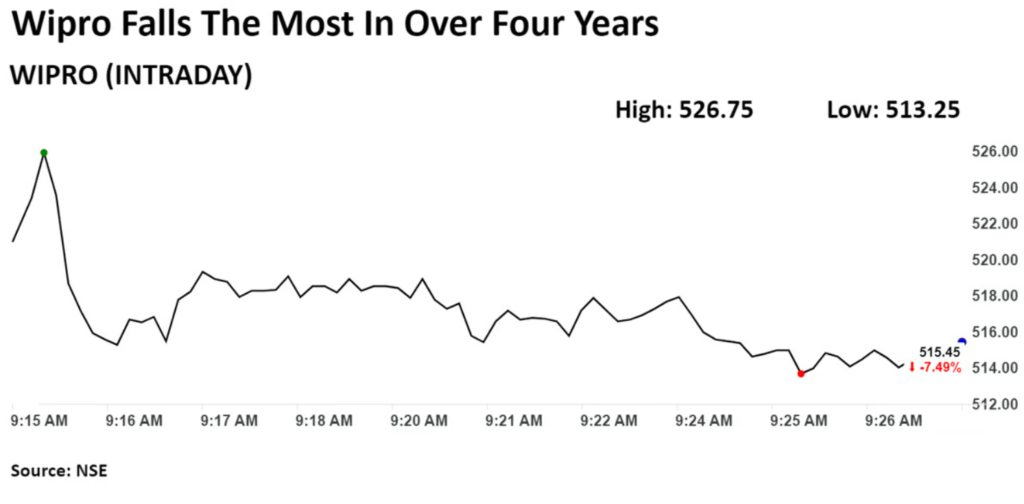

Shares of Wipro, a prominent IT firm in India, dropped nearly 8% to ₹513.25 per share following its disappointing financial results for the June quarter of FY25. This decline reflects the company’s earnings falling short of investor expectations.

Financial Performance and Analyst Reactions

Wipro reported a gross revenue of $2,635.8 million for Q1 FY25, representing a 1.1% decline quarter-over-quarter (QoQ) and a 3.8% year-over-year (YoY) decrease. The IT services segment generated $2,626 million in revenue, down 1.2% QoQ and 4.9% YoY in constant currency terms.

Several brokerage firms responded to the weak performance. Nomura, Citi, and Morgan Stanley maintained their ‘Sell’ ratings but adjusted their target prices:

- Nomura: Target price raised to ₹600 per share.

- Citi: Target price increased to ₹495 per share from ₹455.

- Morgan Stanley: Target price adjusted to ₹459 per share from ₹421.

Sector Performance and Revenue Breakdown

Wipro’s revenue performance varied by sector:

- BFSI: Grew by 0.3% QoQ.

- Energy and Utilities: Declined by 7% QoQ.

- Manufacturing: Fell by 4.2% QoQ.

- Healthcare: Decreased by 2.6% QoQ.

- Communications: Dropped by 1.2% QoQ.

Geographically, the Americas 1 region saw a 0.4% increase in revenue QoQ, while Americas 2 experienced a decline of 0.7% QoQ. Capco, a subsidiary of Wipro, recorded a growth rate of 3.4% QoQ. Conversely, the Europe and APMEA regions faced declines of 1.4% and 4.2% QoQ, respectively.

Margin and Earnings Analysis

Despite the revenue declines, Wipro maintained its operating margin. In the first quarter of FY25, the Earnings Before Interest and Taxes (EBIT) margin grew marginally from 16.4% to 16.5%. This improvement was driven by better utilization, productivity in fixed-price projects, and overhead optimization.

Motilal Oswal cut its FY25E EPS by 1% but kept FY26E EPS broadly unchanged, reiterating its ‘neutral’ rating with a price target implying 20x FY26E EPS. Kotak Institutional Equities retained its ‘Sell’ rating with a target price of ₹460 per share.

Future Outlook and Guidance

Wipro’s management has provided flat IT services revenue growth guidance for the September-ending quarter, projecting revenues between $2,600 million to $2,652 million. This translates to sequential guidance of (-)1.0% to +1.0% in constant currency terms.

With a 9% quarterly decline, the quarter’s total contract value (TCV) was $3.3 billion. The large TCV for the quarter was $1.2 billion, indicating continued interest in Wipro’s large-scale deals despite the overall decline in bookings.

Conclusion

Wipro’s disappointing Q1 FY25 performance has led to a significant drop in its share price and a cautious outlook from analysts. While the company has shown resilience in maintaining its margins and securing large deals, the decline in revenues across various sectors and regions highlights the challenges it faces in a competitive IT services market. Investors are advised to consider these factors and consult with certified experts before making any investment decisions.

For further details, visit the full articles on Mint and The Economic Times.

Tags: Wipro, Q1FY25, IT Services, Financial Performance, Stock Market, Analysts, Earnings Forecasts, Revenue, Margin, Outlook

Also Read:Cheapest available Smartphones in india under 10000